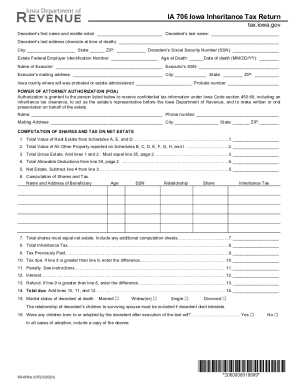

iowa inheritance tax form

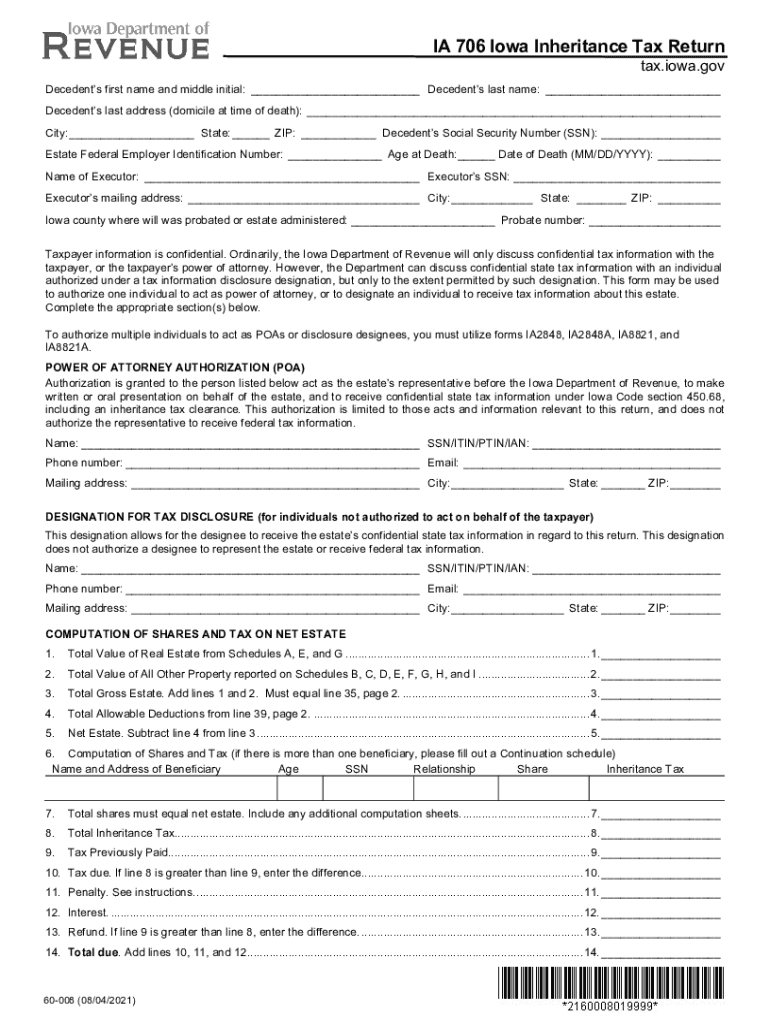

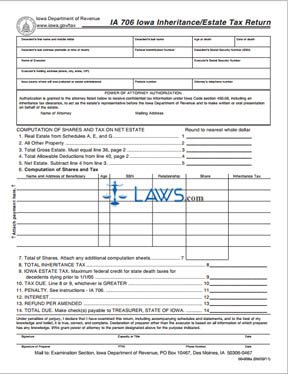

Learn About Sales Use Tax. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

How A Reverse Mortgage Works Definition Eligibility Costs Smartasset Reverse Mortgage Mortgage Fees Mortgage

The good news in light of all this tax talk is that Iowas inheritance tax only applies in certain situations.

. Wait there is a federal estate tax. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Adopted and Filed Rules.

Select the Get form key to open the document and move to editing. Execute Iowa InheritanceEstate Tax - Consent And Waiver Of Lien 60-014 in just a few moments by simply following the guidelines below. Fill out securely sign print or email your 706 iowa inheritance estate tax return 2013 form instantly with signNow.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. File a W-2 or 1099. General Instructions for Iowa Inheritance Tax Return IA 706 Return Required.

Submit all the necessary boxes these are yellowish. Upload the PDF you need to eSign. Track or File Rent Reimbursement.

All the beneficiaries of the estate and their respective shares are included on one form IA706. Learn About Sales. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to the beneficiary or heir.

Read more about Inheritance Application for Extension 60-027. Read more about Inheritance Tax Checklist 60-007. Descendant alone an Iowa inheritance tax return still must be filed.

The Iowa Inheritance Tax is filed using form IA706 which can be downloaded from the Iowa State Department of Revenue website at wwwiowagovtaxformsinherithtml. Law. And there is an inheritance tax It seems Iowa likes its corn with a side of complicated death taxes.

Learn About Property Tax. Do that by pulling it from your internal storage or the cloud. Iowa inheritance tax rules.

If real estate is involved one of the individuals with an interest in or succeeding to an interest in the real estate shall file an affidavit in the county in which the real estate is located setting forth the legal description of real estate. For instance Iowas inheritance tax does not apply if the estate is valued at 25000 or less. The inheritance tax return must include a list of the property in the estate and the value of the property along with a list of liabilities or debts and deductions.

Inheritance Tax Checklist 60-007. Start a free trial now to save yourself time and money. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse.

Therefore it is necessary to first. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. At first glance the Iowa death taxes may seem misleading.

We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our marketing partners and for other business use. Read more about Probate Form for use by Iowa probate attorneys only Print. Not every Iowan who passes away will render their heirs subject to more taxes.

Affidavit and Agreement For Reissuance of Warrant 06-191. Iowa SalesUseExcise Tax Exemption Certificate 31-014. IA 2848 Iowa Department of Revenue Power of Attorney 14-101.

Learn About Property Tax. Law. What is Iowa inheritance tax.

An inheritance tax return must be filed by the fiduciary of any estate when the gross share subjected to tax without reduction for liabilities of any beneficiary heir transferee or surviving joint tenant exceeds the allowable exemption from such share or if a federal return has been filed. Download online State Specific Forms for Iowa last will and testament. IA 8821 Tax Information Disclosure Designation 14-104.

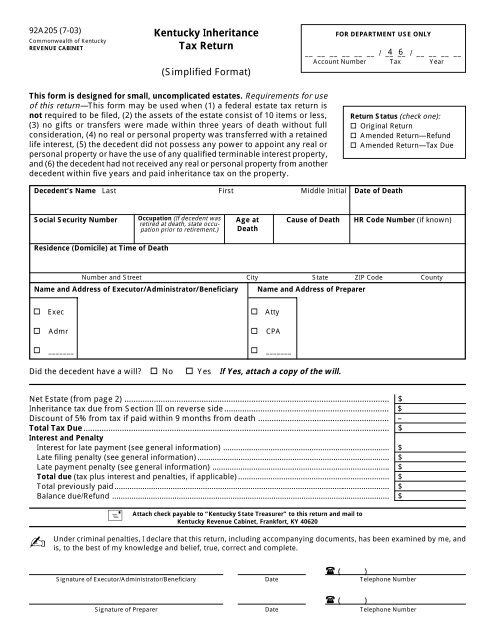

Determination of the kind of filings that. Tax Credits. Inheritance IA 706 Instructions 60-066.

Learn About Property Tax. Use Get Form or simply click on the template preview to open it in the editor. Create an account using your email or sign in via Google or Facebook.

In the meantime there is a phase-out period before the tax completely disappears. Adopted and Filed Rules. This document is found on the website of the government of Iowa.

Iowa InheritanceEstate Tax Return IA 706. Register for a Permit. Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers.

File a W-2 or 1099. Change or Cancel a Permit. Iowa InheritanceEstate Tax Return IA 706 Step 1.

Each individual should use his or her judgment on whether to file a short form probate inventory with the Clerk of the District Court or whether filing a simple affidavit of the death of the joint tenant is sufficient for title purposes. Theres no state estate tax yay. Iowa inheritance tax rates.

Tax Credits. 11 hours agoIowa ranked in the top 10 for recently legislated tax changes 2020 2021 per 1000 of personal income decrease of 221 fourth. Inheritance Application for Extension 60-027.

Penalty Waiver Request 78-629. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Learn About Sales.

Start completing the fillable fields and carefully type in required information. Representative Certification Form 14-108. Property in the Estate.

Iowa Inheritance Tax Return. Quick steps to complete and eSign Iowa Inheritance Tax Form online. Iowas Inheritance Tax.

Choose the template you require from the library of legal form samples. Deadlines for filing Iowa inheritance tax forms. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

To sign a iowa inheritance tax form 2011 112862 right from your iPhone or iPad just follow these brief guidelines. Install the signNow application on your iOS device. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

File a W-2 or 1099. Available for PC iOS and Android. 1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Referredtoin321474215942160450B1450B2450B5450B7602810263.

Iowa Law Relating To Collateral Inheritance Tax A Complete Compilation Of The Iowa Statutes Relating To Collateral Inheritance Tax With Annotations From The Courts Of Iowa And New York

Arizona Estate Tax Everything You Need To Know Smartasset

Selected Digitized Books Available Online Inheritance And Transfer Tax Library Of Congress

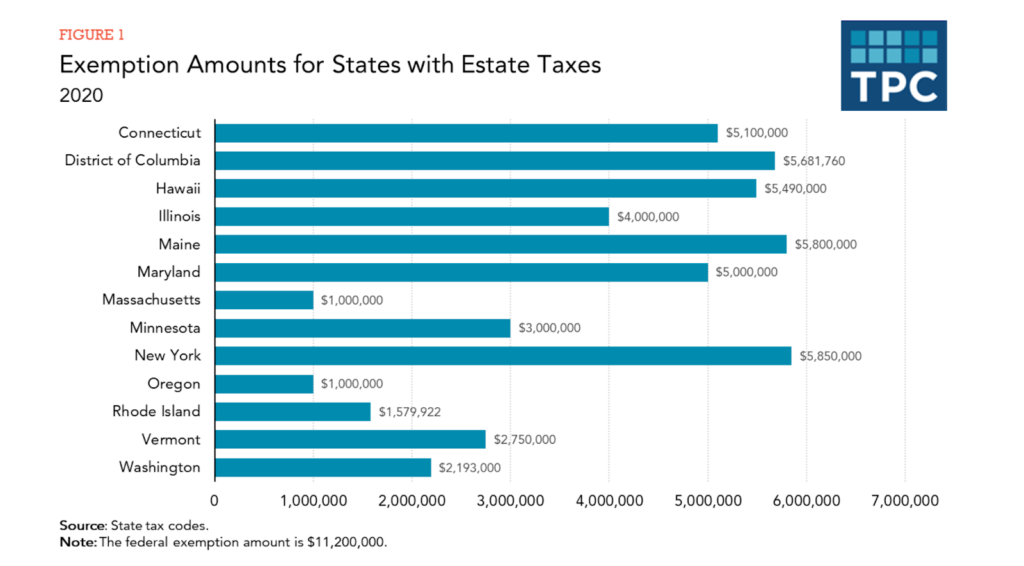

All You Need To Now About Inheritance Taxes At Federal And State Level

Iowa Estate Tax Everything You Need To Know Smartasset

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

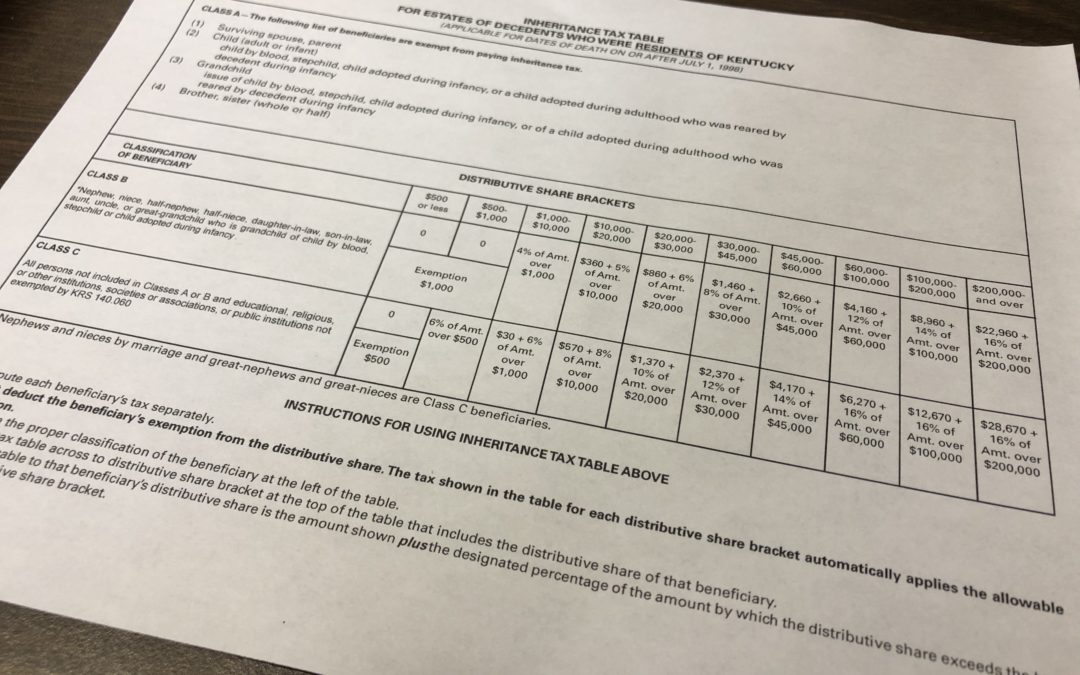

Kentucky S Inheritance Tax Brackney

Kentucky Inheritance Tax Return Formsend

Do I Have To Pay Taxes When I Inherit Money

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

How To Make Your Own Will And Testament In Texas Will And Testament Last Will And Testament Writing

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Iowa Estate Tax Everything You Need To Know Smartasset

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

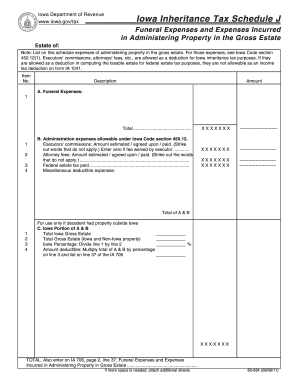

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller