child care tax credit 2022

The Bureau of Labor Statistics reports that the workforce in the childcare industry has. To qualify you must.

The 5 Biggest Tax Breaks For Parents In 2022

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

. Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. 3600 per child under 6 years old.

Dependent credit after 2021. Tom Wolf has approved a new permanent child care tax credit that will allow families to claim thousands of dollars in benefits. That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous.

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth. Single or married and filing separately.

Have income between 1 57414. The American Rescue Plan Act provides payment of 1400 for individual tax filers who earn up to 75000 per year and 2800 for joint filers who earn up to 150000 per year. 2022 Tax Changes.

The state child care tax credit is for 30 of the federally approved expense. Enhanced child tax credit. For 2022 the tax credit returns to its previous form.

Jul 15 2022 0 You May Also Like IMAGE. 3000 per child 6-17 years old. Aggregate tax expenditure amount billions for the child tax credit CTC for calendar years 2022-25 under three scenarios.

Child Tax Credit sees up to 1600 cut per child October 27 2022 Rob Flaks SALISBURY MD- Key parts of the American Rescue Plan and the aid it gave to. Expanded Child Tax Credit available only through the end of 2022. TCAC verifies that the developers have met all the requirements of the program and ensures the continued.

Eligible households can receive up to 6728. File a federal income tax return. Todays Social Security column addresses questions about earning delayed retirement credits DRCs while receiving child-in-care spousal benefits the possibility and.

Extension of the American Rescue. Corporations provide equity to build the projects in return for the tax credits. If you received advance.

Up to 4000 for one qualifying person for example a dependent. Concretely today parents who have their child under the age of six looked after in a crèche a day care center or with an approved childminder can benefit from a tax credit equal. Pennsylvanians paying for child care services will be able to claim the credit when filing state.

Use the child care tax credit to save on your 2022 taxes Families can save up to 1200 with this tax deduction for child care expenses Desiree Leung December 17 2021 Once families find a. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible taxpayers. The new tax credit was.

1200 sent in April 2020. To apply applicants should visit. For tax year 2022 the dependent care credit will revert to.

To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. You will then multiply your work-related expenses by a.

People who care for two or more dependents will be able to claim up to 6000 in child care expenses starting next year. 2 days ago IRSnews IRSnews October 29 2022. Child Care Providers Are In Record Short Supply.

HARRISBURG Gov. The maximum care expenses you can claim is 3000 for one person or 6000 if you have more than one dependent. The credit is calculated based on your.

File with a Social Security Number.

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

Stephen Lecce On Twitter Ontario Is Putting More Money Back Into The Pockets Of Families This Tax Season The Ontario Child Care Tax Credit Care Is Increasing Support To 1500 Per Child

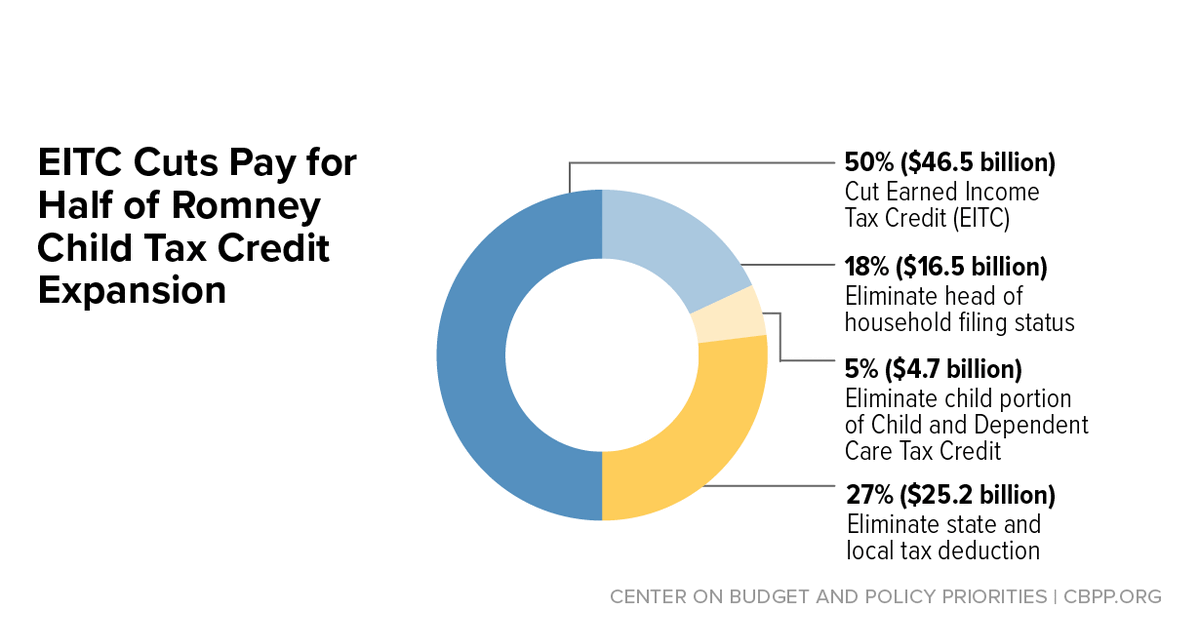

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

State Budget Deal Includes New Child Care Tax Credit Columbia Montour Chamber Of Commerce

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is The Child Tax Credit Tax Policy Center

Gov Wolf Child Care Tax Credit Program Eyewitness News

Child Tax Credit State S New Child Care Tax Credit Allows Up To 6 000 Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Taxes 2022 Are You Eligible To Claim The Child And Dependent Care Tax Credit

:format(webp)/https://www.thestar.com/content/dam/thestar/business/2022/02/21/with-2021-tax-returns-coming-due-these-ontario-credits-are-aimed-at-parents-seniors-and-low-income-workers/mary_fraser_hamilton.jpg)

Ontarians Receive 7 Tax Credits In 2022 The Star

Irs Offers Overview Of 2021 Tax Provisions In American Rescue Plan Nstp

Current Child Care Tax Credit Download Table

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

Smotrite Populyarnye Video Ot Child Tax Credit 2022 Tax Return Tiktok

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

Use The Child Care Tax Credit To Save On Your 2022 Taxes Care Com Homepay

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Daycare Tax Credit 2022 Can You Claim Daycare On Taxes Marca